There are many benefits to investing in a 401(k). A 401(k) is a tax-advantaged retirement account offered by many employers to employees. The maximum amount an employee may contribute to their 401(k) is adjusted periodically by the US government. In 2021, the 401(k) maximum contribution is $19,500 for employees under 50 years old and $26,00 for employees 50 years and up. One day, I hope all of us make it to 59.5 years old. This is the age that you may start taking money out of your 401(k) penalty free! If you are on the path to financial independence, you must seriously consider investing in your 401(k) (if you have one). I’ll go over the reasons this savings and investment strategy should be a priority.

- Automatic deductions from your paycheck. As Robert Kiyosaki says, “Pay yourself first.” Don’t even give yourself the option to spend the money. Simply, set up an automatic contribution and make saving for retirement a critical aspect of your financial portfolio. You can either pick a dollar amount or a percentage of your pay that will be immediately allocated to your 401(k). The money will never hit your checking account and you will not notice it’s missing. Instead, you can watch it grow. Automation makes saving for retirement a priority without trying!

- Employer match. Companies often offer employee matches meaning, they will match your contribution to a specific dollar amount. Matches may range from as little as a few hundred dollars to 100% of your contribution. This means free money. Even if you are in huge amounts of debt, you should at least invest up to the employer match. If you don’t, you’re leaving money on the table.

- Tax benefits

- Contributions are tax deductible and lower your taxable income. Let’s look at a really simple example. Let’s say you made $136,000 annually from your job. In 2020, this puts you in the 24% tax bracket and you would owe the government $26,719.50 in federal income taxes. In comparison, let’s say you contributed the maximum amount ($19,500 in 2020) to your 401(k). Instead of paying income tax on $136,000 your new taxable income would be $116,500 ($136,000 – $19,500). With this new taxable income, you would pay 21,799.50 in federal income taxes. That’s more than a $5000 that you get to invest!

- In addition to saving money in taxes, you money grows tax-deferred. The earnings on your 401(k) investment are rolled back into your 401(k) investment and are not listed as income until you withdraw the funds.

- Compounding interest

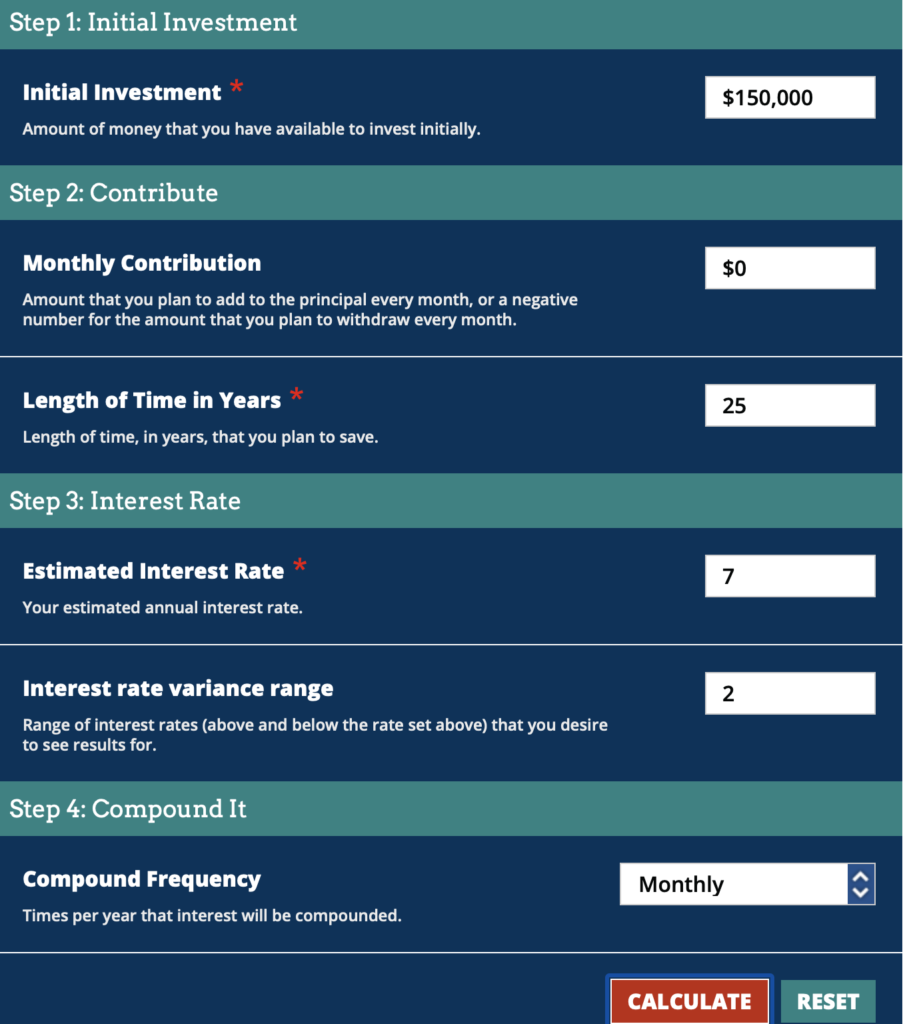

- Compounding interest is an extremely powerful tool to grow wealth, but it takes time. Let’s play with some more numbers. Check out this compounding interest calculator (link) and play with some numbers.

As you can see from my example, if you invested $20,000 into your 401(k) every year for the next 30 years, you would have $2.1 million dollars (depending on the market performance). Now, I realize this is a financial independence blog and some of us may plan to quit much sooner than 30 years, but use think of this also as an example of the power of compound interest. If you’re comfortable working until you’re 59.5 years (the age you can start withdrawing money from your 401(k) without penalties), then there is a huge advantage to contributing to your 401(k) as soon as possible.

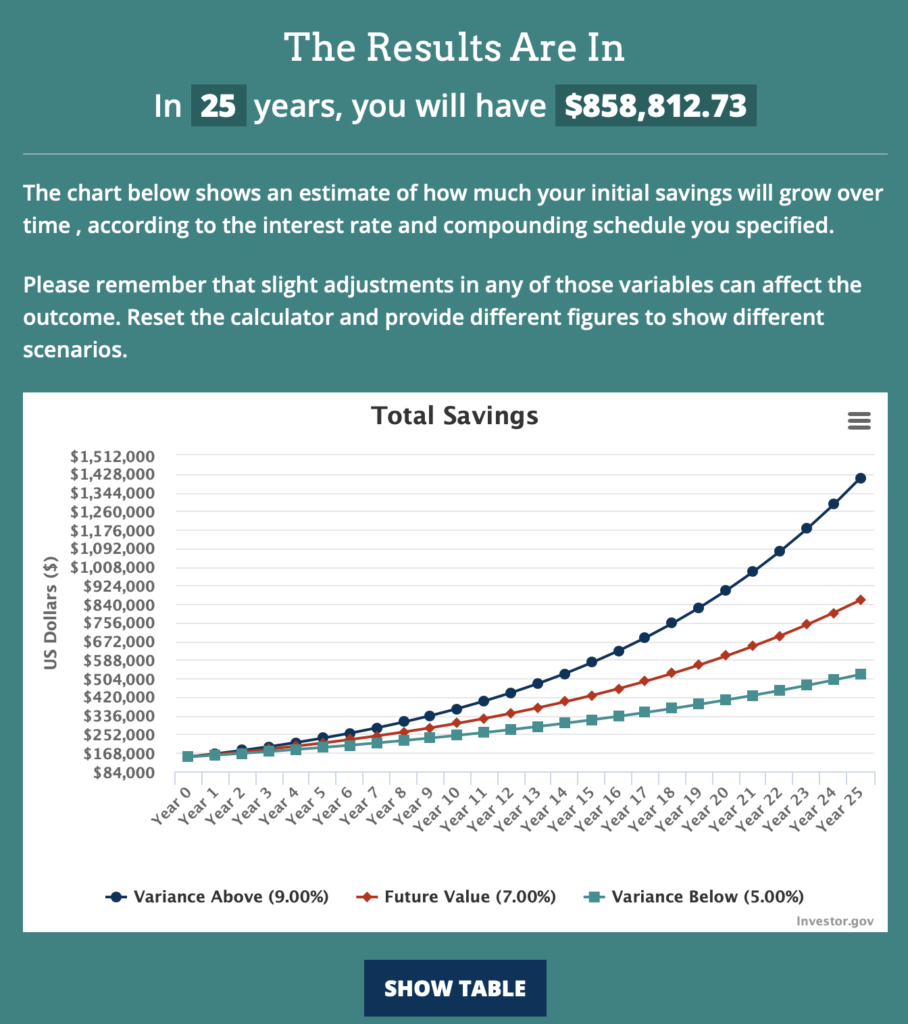

Alternatively, let’s say you’re 30 years old and plan to retire at age 35. If you contribute approximately $20,000 (the maximum contribution changes annually) into your 401(k) for the next 5 years, you might expect about $150,000 in your account. Then you stop contributing entirely and allow that $150,000 to grow for the next 25 years. The money in your account could grow to about $1 million, as shown below:

In the above examples, I conservatively estimated a 7% interest rate, but if we assume an 8% interest rate, we can expect our money to double about every 7 years.

- You automatically take advantage of dollar cost averaging. Since you can set up your 401(k) contributions to be automatically deducted from each paycheck, you buy more shares when costs are low and you buy fewer shares when costs are high. Overtime, you consistently invest the same amount of money each month, which reduces the average cost of all of your shares.

- 401(k) hardship withdrawal. This allows you to withdraw money in times of emergency. Many plans offer loans or hardship withdrawals as a way to get out of financial emergencies, but there are penalties involved with withdrawing early. It’s a better idea to set up a solid emergency fund with 3-6 months of savings before you start seriously investing in your 401(k).

- Roth IRA conversion ladder.

- If you have a good CPA, they can help you remove money from your 401(k) into your Roth IRA. Then, there is a 5 year holding period, in which you must allow the investment to sit. After the money ages 5 years, you can withdraw the money tax free. If you plan to use this strategy for early retirement, you need to start converting money from your 401(k) to you Roth IRA 5 years before you plan to withdraw the money. This method can be tricky, so be sure to consult a professional before attempting this method. Additionally, if you start using your retirement savings early, you need to be sure you won’t fall short of investment money when you reach a traditional retirement age.

I hope this gives you reasons to contribute to your 401(k)! I believe it’s worth contributing, even if you can’t contribute the full amount, at least contribute up to your employer’s match you’re your employer offers a match). Regardless of whether you plan to retire early, you will most likely get old and we have to think about how we will take care of ourselves when we get there.